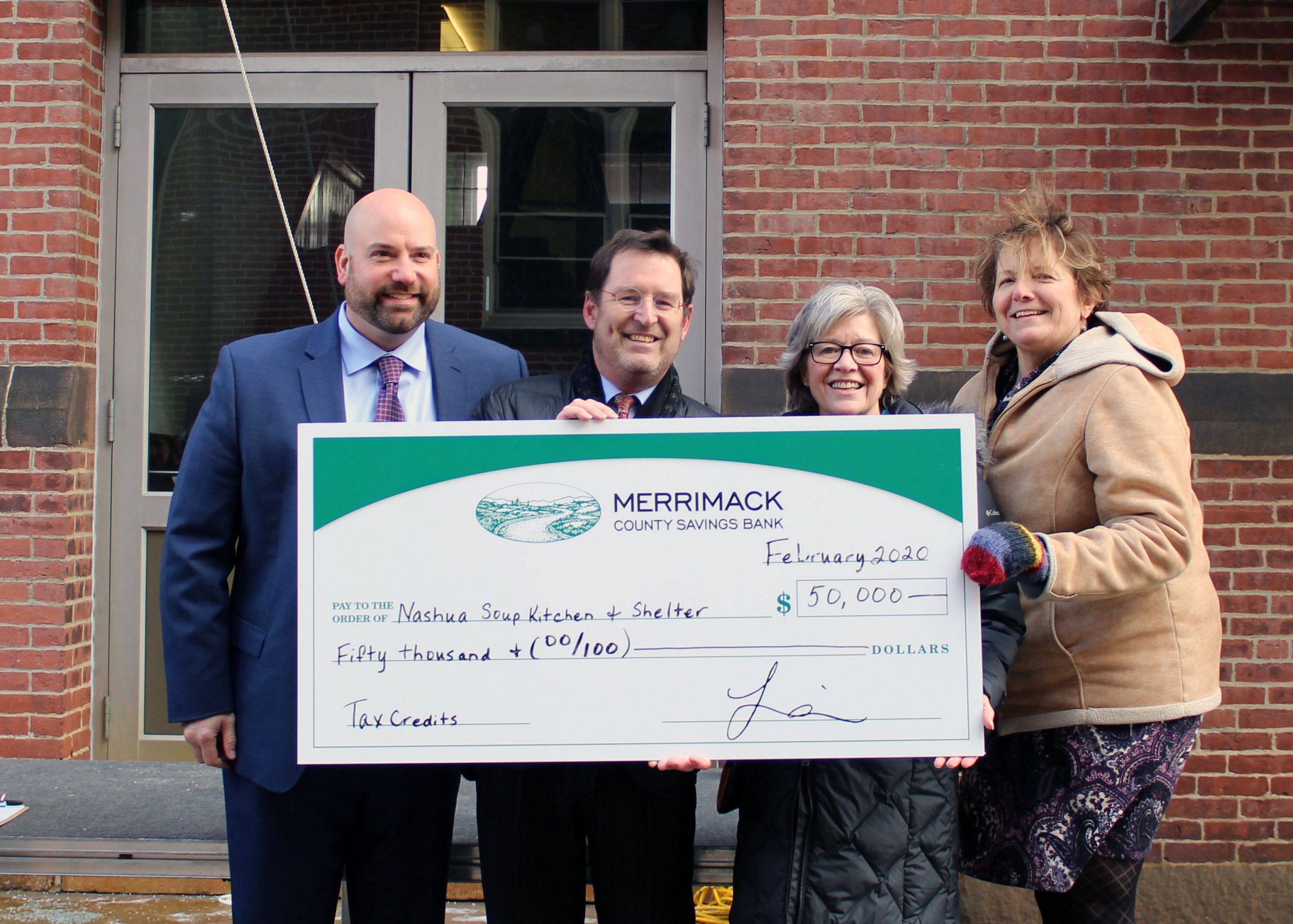

Left to Right: Randy Sivigny, Vice President, Commercial Loan Office for The Merrimack, Michael Reinke, Executive Director, of the Nashua Soup Kitchen and Shelter, Linda Lorden, President of Merrimack County Savings Bank, Debbie Stoodley, Branch and Business Manager of The Merrimack’s Nashua Office.

Merrimack County Savings Bank (The Merrimack) recently purchased $50,000 in tax credits through the New Hampshire Community Development Finance Authority (CDFA) in support of Nashua Soup Kitchen & Shelter (NSKS). The Bank’s investment will go toward the renovation of the former Sacred Heart Elementary School on 35 Spring Street in Nashua, which is being converted into a homeless shelter with several units of permanent housing. The building is adjacent to St. Patrick’s Church.

The new facility will provide the Nashua community with increased access to critical services, including a 24-unit homeless shelter for single women and families, plus 11 new units of permanent housing. In partnership with Saint Patrick’s Parish, NSKS will convert the former Spring Street Sacred Heart School into an emergency shelter by the year 2021.

“The Merrimack is proud to support Nashua Soup Kitchen & Shelter and their endeavor to provide assistance and access to shelter for Nashua’s most vulnerable population,” said Linda Lorden, President of Merrimack County Savings Bank. “Strengthening the well-being of our communities is what the Bank was founded on 153 years ago. We’re thrilled to be able to continue that tradition by helping great community organizations like the Nashua Soup Kitchen & Shelter.”

“We’re incredibly grateful to The Merrimack and their belief in us to help eradicate homelessness in Greater Nashua,” said Michael Reinke, Executive Director, of the Nashua Soup Kitchen and Shelter. “This project will allow us to better respond to the critical need for emergency shelter that Nashua families experiencing homelessness are facing. We can’t thank The Merrimack enough for their generosity.” NSKS is currently the only local organization to provide emergency family shelter, serving all clients without any need for identification.

The Nashua Soup Kitchen & Shelter was founded in 1981 to provide shelter and food to those in need. The NSKS works to end homelessness and to alleviate poverty as well as the conditions that force individuals and families with children into hunger and homelessness. Located on 2 Quincy Street, NSKS has served the Greater Nashua area for the last 39 years by advocating, creating and operating programs and services that promote dignity and self-sufficiency. For more information, visit nsks.org.

CDFA tax credits allow businesses to fund qualifying economic or community development projects in exchange for a tax credit that can be applied against state business tax payments. The tax credits are administered by the New Hampshire Community Development Finance Authority (CDFA). Any business with operations in NH that contributes to a CDFA tax credit project receives a NH state tax credit worth 75% of their contribution. The credit can be used over a period of five years to reduce the business’ state tax liability (business profits, business enterprise or insurance premium taxes). The tax credit program allows NH businesses to use their state tax dollars to support local projects that they care about. CDFA reviews many project applications each year and awards tax credits to those they determine are feasible and will make the biggest impact on economic development in the state. For more information, visit nhcdfa.org.